THE RAW MATERIALS CRISIS

A STRUCTURAL PROBLEM FOR EUROPE

"A perfect storm" is how AGI (Agenzia Italia) defines it. It is not just a matter of COVID, the pandemic has only revealed the problem. The causes of this situation are structural and are the consequence of a dangerous policy of

Europe deindustrialisation, which firstly transferred production and then the interest of sellers towards the markets of CHINA and the USA. All this has led to a

dependence on these countries (which are, moreover, recovering strongly) for both semi-finished products as well as raw materials.

To these we must then add the

“safeguard measures” provided by European legislation, which impose the application of duties of 25% when the import limits for certain raw materials from “non-EU countries” are exceeded.

THE RISING COST OF OIL-RELATED PLASTICS

Also contributing to the crisis is the sharp rise in the price of "Brent" from the lows reached in April (+148%). Polymers of reference for the manufacturing industry such as ethylene, polypropylene and PVC reported price increases of 58%, 34% and 42% respectively. Source: AGI | Agenzia Italia

THE POOR AVAILABILITY OF RAW MATERIALS

To the problem of cost, we must also add the problem of low availability. Indeed, with the strong growth in domestic demand by China and USA and in global demand from the second half of 2021 onwards, the availability of raw materials is expected to be an even more damaging problem than cost, by putting the production of many other industrial sectors at risk, certainly including steel and plastics, both of which are strategic for a modern economic model such as Europe's.

THE SECOND LIFE RAW MATERIAL ALTERNATIVE

In a scenario where "virgin raw materials" are scarce or too expensive, the use of “second life raw materials” could open up new perspectives.

Research shows that many second life (recycled) materials could be a viable alternative to virgin (first choice) raw materials, especially if adopted by mature markets with infrastructure which are ready to support a circular economy such as Europe.

In this area and in recent years, important progress has been made in many sectors such as ferrous alloys, municipal waste in general and polymers.

A REVERSAL PERSPECTIVE FOR THE CIRCULAR INDUSTRY

In the last two years we have seen in Europe a worrying slowdown in the circular industry and in particular in recycled plastics. This was due to the free-falling prices of virgin material and to the slowdown in production due to Covid-19.

"If the situation is to persist and no actions are taken to remedy the sector, plastics recycling will cease to be profitable, hampering the attainment of the EU recycling targets and putting in jeopardy the transition towards circular plastics’. In such a case, recyclable plastic waste will have no alternatives but to be sent to landfill or incineration.". Ton Emans, President of Plastics recyclers Europe

However, from Q1 2021 onwards, we are witnessing a new paradox with the cost of products made from virgin PP rising exponentially in relation to the cost of C3 (the basic material for making polypropylene).

This obviously has a major impact on the final cost of the product.

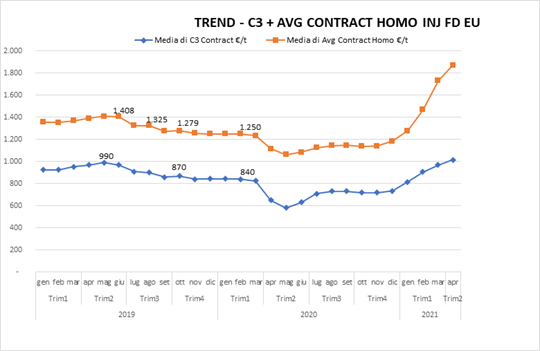

Cost trend €/t PP in Europe.

In orange the average PP cost. In blue the cost of C3 (basic material to produce PP)

The only justification we can give is unprecedented speculation on the part of the respective manufacturers.

It has to be said that the recycled raw material is also undergoing a cost increase, but the impact on the end product is simply proportionate and not exponential.